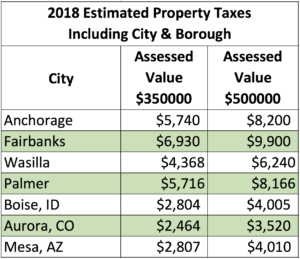

According to the Alaska Department of Commerce, Anchorage’s mill rate of 16.4 is the second highest in Alaska. Only Fairbanks has a higher mill rate of 19.8. In Anchorage the tax on a $350,000 home is $5,740 and $8,200 on a $500,000 home, excluding any exemptions entitled to the property owner. In Fairbanks, those same home values would be taxed at $6,930 and $9,900. Unlike most other Alaskan communities, neither Fairbanks nor Anchorage has a borough or sales tax which places the local tax burden squarely on property owners.

When comparing Anchorage’s property taxes to Boise Idaho, its tax on a $350,000 home is $2,804 and $4,005 on a $500,000 home. In Aurora, Colorado, the tax is $2,464 and $3,520 respectively. In Mesa, Arizona, the tax is $2,807 on a $350,000 and $4,000 on $500,00. I’ve used those cities as comparison because all three have populations under $500,000.

Anchorage’s l6.4 mill rate significantly contributes to the high monthly cost of our housing. Shaving $3,600 off a tax bill on a $350,000 home would create more buyers in the market who would have to earn $1,000 less per month in order to qualify for a mortgage. Home ownership creates social and economic stability for a community whether it’s here or in Arizona. I encourage Anchorage’s assembly to explore other opportunities for taxation to relieve the tax burden on home owners. The 12 year tax abatement for the development of residential properties in the downtown business district is a good first step but it doesn’t help the average home buyer who, according to national statistics, still wants to live in a single family home.

Connie Yoshimura is the Owner and Broker of Berkshire Hathaway HomeServices Alaska Realty. With over 40 years of residential real estate experience, she continues to be a leader in Alaska’s housing market. Most recently, she sold the highest-priced home ever recorded in the Alaska MLS.

Connie Yoshimura is the Owner and Broker of Berkshire Hathaway HomeServices Alaska Realty. With over 40 years of residential real estate experience, she continues to be a leader in Alaska’s housing market. Most recently, she sold the highest-priced home ever recorded in the Alaska MLS.

Leave a Reply